Why Annuities?

The concept of retirement has changed drastically over the past 45 years. Retirement

for our parents relied on their Social Security income and their Pensions. A pension

was basically a lifetime contract. You received a fixed monthly income for the rest

of your life, and some pensions also included cost of living increases!

In 1974 the Employee Retirement Income Security Act created the IRA where you could

save money tax free until you needed it for retirement. Then in 1979 a provision

was added to the Internal Revenue Code, Section 401(k), which allowed employees and

employers to transfer pre-tax income directly into retirement saving accounts.

Pensions today are being replaced by 401Ks and IRAs. These are merely different

methods of saving for retirement. There is no contract and when the money runs out,

the income stops, and stock market volatility and taxes can play significant roles

in how long our savings will last.

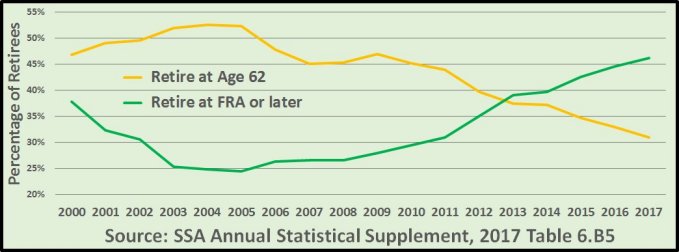

Longevity is becoming a major factor in our retirement. Will you outlive your money?

Retirees are beginning to recognize the importance of larger fixed income sources

for the rest of their lives. The latest SSA Statistical data shows how the larger

percentage of retirees who were starting their benefits at age 62 back in 2004 are

now being overtaken by those who are waiting until their Full Retirement Age or

later. The longer you wait, the larger your lifetime income level.

But Social Security alone does not supply you with a large enough guaranteed fixed

income stream. Your 401k and IRA accounts are generally invested in the market which

can be volatile and unpredictable. The market does not "guarantee" that your money

will outlast your longevity.

One of the best horrible investments you can make!

We like to call our annuities the best horrible investments we have made, but that

terminology is incorrect. An Annuity is not an investment which grows and falls with

the market. It is a contract that guarantees a fixed income stream

for the rest of your life.

There are many different kinds of annuities that you can purchase, and each annuity

company has their own special ways of making theirs look like the best.

Our annuities, like most, are divided into two parts; the annuity value side, and the

cash value side. If you are looking for a great return on an investment, then you will

probably feel like we do that the cash value side is a horrible investment! In our case,

there was an immediate 8% bonus, but there is no guarantee that the cash value will

continue to grow, and there are a number of early withdraw penalties if we ever say,

"Give us our money back"! Also, since we included a form of life insurance, the cash

value can actually decline due to "fees".

The guaranteed lifetime annuity side is why we made the purchase. We received an

immediate 8% bonus and the annuity value continues to grow by 7% per year until we start

the annuity payments. The annuity payout percentage also grows by about 2% each year

which makes the payout value grow by about 9%.

When you start the payout, the lifetime income will be fixed for the rest of your life.

Each yearly payout will be deducted from the cash value side. If you die before the cash

value drops to zero, the remaining cash value will be a life insurance payment to your

heirs.

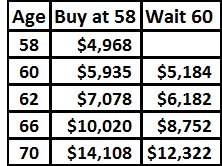

Let's look at a real life example! This

chart illustrates the differences in buying a $100,000 Annuity at the age of 58 vs

waiting until age 60. The first thing to notice is that the age 60 annual payouts are

about 12.7% less than the age 58 annual payouts. The size of your annual payments grows

the longer you wait to start your payments, and your cash value life insurance value does

continue to grow while you wait, even though, as mentioned above, it does grow at a

relatively small rate. Let's look at a real life example! This

chart illustrates the differences in buying a $100,000 Annuity at the age of 58 vs

waiting until age 60. The first thing to notice is that the age 60 annual payouts are

about 12.7% less than the age 58 annual payouts. The size of your annual payments grows

the longer you wait to start your payments, and your cash value life insurance value does

continue to grow while you wait, even though, as mentioned above, it does grow at a

relatively small rate.

Note: Most annuity companies do not allow you to split an annuity into multiple

parts, start half of your payout at age 66 and the other half at age 70. For that reason,

if you are considering one large Annuity, it will give you more flexability if you

purchase a series of smaller Annuities.

|